Working on the timing side with Gann and Elliott together takes quite a bit of time but the outcome is amazing!

According to W.D.Gann a trend is "balanced out" when moving along a 45 degrees line, meaning that a "time unit" (a day) must be equal to a "price unit".

Alright. A time unit is "one day" but ... how many index points is a price unit in the S&P500?

I calculated (I might be wrong) that every 36 TRADING days the S&P500 should climb 118.16 points to be on a 45 degree line, meaning 3.2822 points/day which is our "price unit".

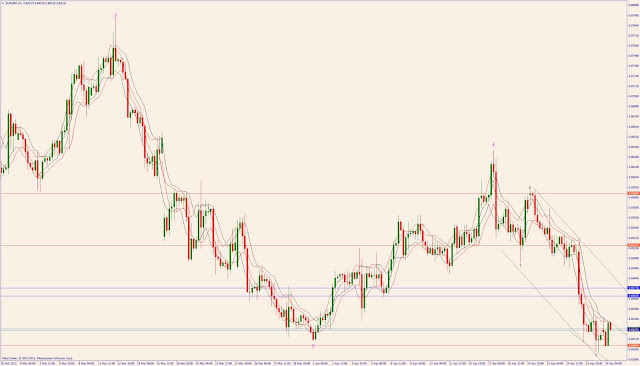

Now, check the daily chart below as I found out that, from early June 2012, the S&P500 futures recorded highs and lows every 36 days with a Swiss watch precision!

Furthermore, by combining Elliott Waves and Gann Timing you get a projection of a "possible" calendar day for the next incoming High/Low which should comes to Friday May 24 or Monday May 27, US East Coast Standard Time (a day ahead for Australia).

NOTE: I said High/Low, meaning that can be either one. I can only specify the calendar date.

Finally, take all this with a "pinch of salt" and, please, give me some feedback, included any negative "honest/competent" opinion.

PS: I've repeated this analysis with the SPI200: the new High/Low comes a trading day later.

click to enlarge

For the SPI200 below calculations where a bit more complicated but with the same similar (timing) Swiss precision and outcome, so I won't comment any further.

You may want to contact me for a quick chat. In meantime, check the daily chart below and the weekly chart further down which confirms the same calendar date.

click to enlarge

Below the weekly chart of the SPI200

click to enlarge